Knowledge

Knowledge

Listen

A

Podcast

Aug 9, 2022

·

PAP#140

“What got us here won’t get us there”: How revenue operations help you scale

Listen

A

Podcast

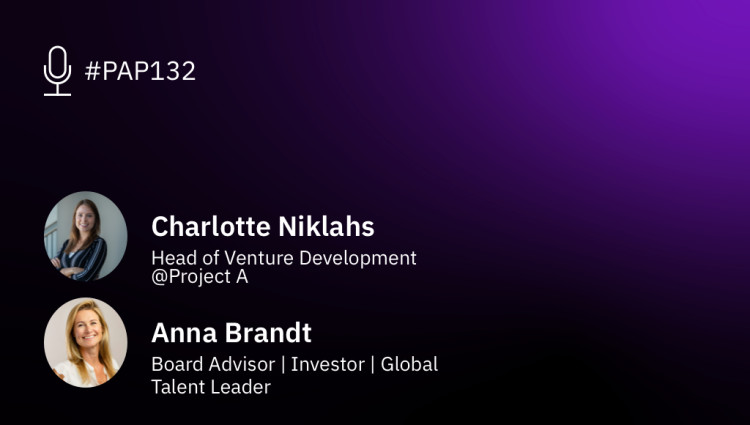

May 25, 2022

·

PAP#132

Scaling your organisation successfully: Learnings from Zalando, N26, and Uber

Listen

A

Podcast

Nov 26, 2021

·

PAP#120

Data, Dev Tools, Open Source: Why Project A is doubling down on software infrastructure

Listen

A

Podcast

Oct 16, 2020

·

PAP#097

Enabling scalability of your marketing automations: GPredictive & CrossEngage join forces

Listen

A

Podcast

Oct 9, 2020

·

PAP#096

Virtual conferencing on the rise - use for Marketing, Sales and Networking

Listen

A

Podcast

Jul 3, 2020

·

PAP#092

Wonderbly - Building a tech-enabled, global publishing business with personalized books

Listen

A

Podcast

May 1, 2020

·

PAP#088

A Closer Look Into Programmatic Advertising, Audience Segmentation and Campaign Targeting

Listen

A

Podcast

Mar 7, 2020

·

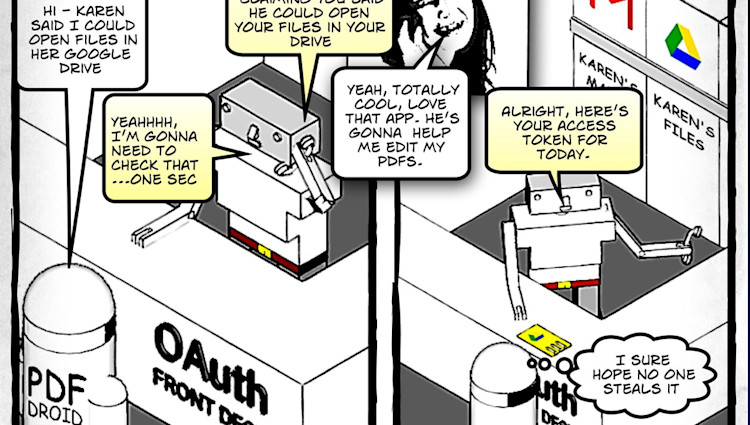

PAP#086

Paranoia is healthy! (when it's about data security)

- Date

- 2020-03-07

- Location

- Start

Listen

A

Podcast

Feb 8, 2020

·

PAP#084

Changing an established industry step by step - Laserhub's pragmatic approach to industry 4.0

Listen

A

Podcast

Nov 15, 2019

·

PAP#077

DDD Ecosystems & Communications over Distributed Systems @ Project A Knowledge Conference 2019

Listen

A

Podcast

Nov 1, 2019

·

PAP#075

Uncomplicated Marketing Automation Systems @ Project A Knowledge Conference 2019

Listen

A

Podcast

Oct 18, 2019

·

PAP#073

Engineering 101: Dependency Injection in JavaScript @ Project A Knowledge Conference 2019

Watch

A

Video

Sep 27, 2019

PAKCon 2019 - Opening & How to make your company more diverse

- Date

- 2019-09-27

- Location

- Start

Watch

A

Video

Sep 27, 2019

PAKCon 2019 – Remote Work: How To Manage A Global Organization

- Date

- 2019-09-27

- Location

- Start

Watch

A

Video

Sep 27, 2019

PAKCon 2019 – 6 Rules for Building Performing Companies

- Date

- 2019-09-27

- Location

- Start

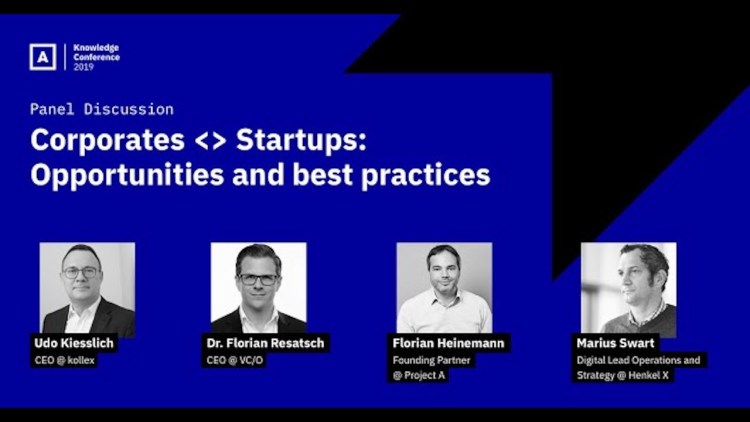

Watch

A

Video

Sep 27, 2019

PAKCon 2019 – Corporates & Startups 2019 - Opportunities and best practices

- Date

- 2019-09-27

- Location

- Start

Watch

A

Video

Sep 27, 2019

PAKCon 2019 – Personal Branding & Personified Marketing

- Date

- 2019-09-27

- Location

- Start

Listen

A

Podcast

Jun 28, 2019

·

PAP#057

Die Anwendung neuropsychologischer Erkenntnisse auf die Unternehmenskommunikation

Listen

A

Podcast

May 31, 2019

·

PAP#053

How important is applied AI for the positioning of a company in the travel space?

Listen

A

Podcast

May 24, 2019

·

PAP#052

Combining Sales & Marketing Activities to Master Lead Generation @b2b Marketing & Sales Day

Listen

A

Podcast

May 10, 2019

·

PAP#050

The Dixa Sales Playbook - 5 factors to consider for a successful sale @b2b Marketing & Sales Day

Listen

A

Podcast

Feb 1, 2019

·

PAP#036

Durch Online Location Marketing Offline Traffic generieren - Warum ist das relevant?

Listen

A

Podcast

Jan 11, 2019

·

PAP#033